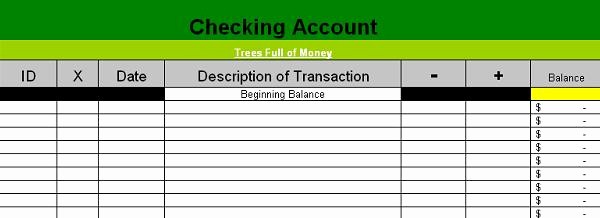

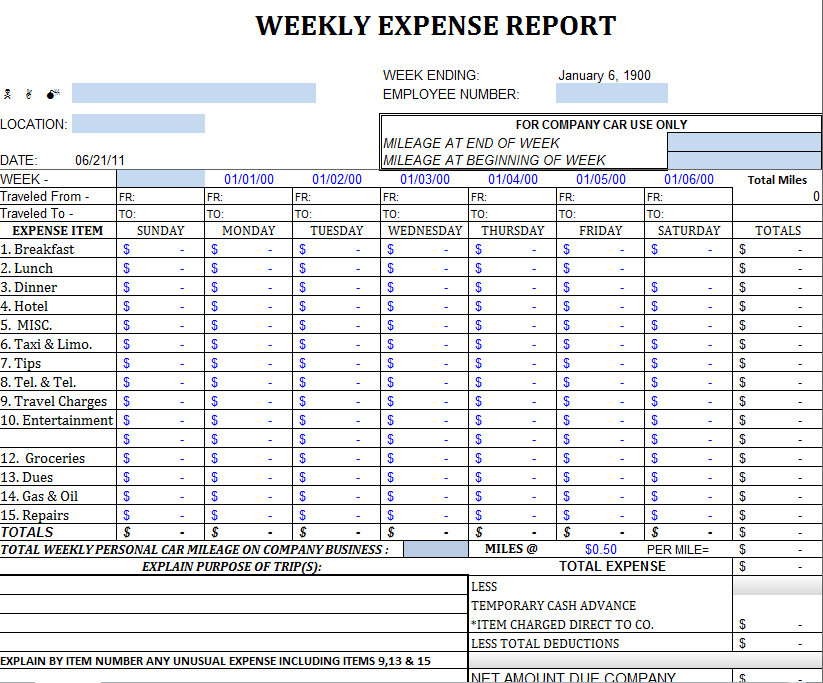

All this means is that you have to wait a few weeks before seeing a finalized P&L figure for the previous month. Still use all the actual dates of your transactions and simply mark as reconciled all the transactions up to the 15th of the month. However, a lot of the time Credit Card Statements end with a closing balance on a 15th or something similar. The expense form template for each month runs from the 1st of the month to the 31st (or 30th) of the month. what to do if your credit card statement ends in the middle of the month (not on the last day) R stands for Reconciled, C stands for checked, X stands for checked and the dash can mean anything you want! Select any one that you fancy using. You can use the last column Headed R to mark each transaction as Reconciled as you check them off your Credit Card Statement. Your aim is to make sure that the expense form template balance matches the credit card account balance, so whether you access it through internet banking, or you wait for a paper statement to arrive, make sure the template matches it. If the amount of the purchase has not yet been deducted from the total balance, then leave it off until the date that it does change the balance.This will keep your credit card balance accurate to the date. If the amount of the purchase has been deducted off your credit card from the total balance on the date of purchase, then enter it into the expense form template on that date.So how should you handle this in your expense form template? Say you bought a laptop on 31 January for $800, if you use Internet Banking and check your credit card details, you will most likely find that even though the credit card balance has increased by $800 (and even that might take a few days to occur), when you look at the details on the credit card transaction page there may be no details yet - it might just say Electronic Transaction or something similar and not yet show the name of the business you bought the laptop from.

It can often take up to 5 or more days for a transaction to be processed and cleared on your credit card.

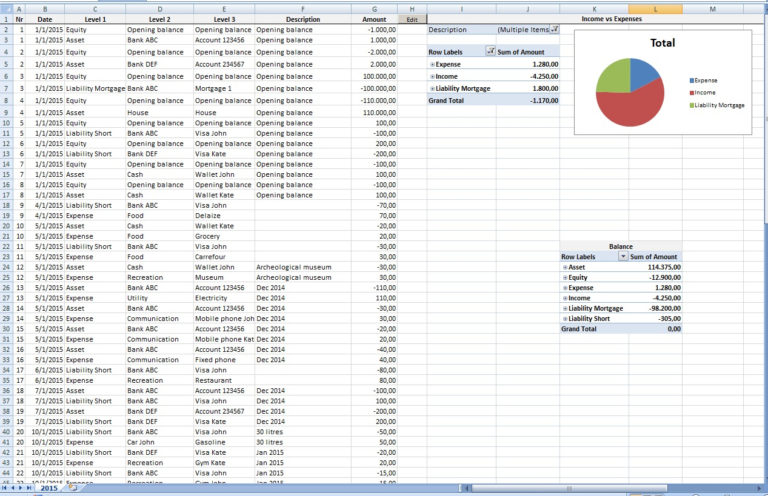

Only the amount that you spent that is owed to the creditĬard company is what should be shown. The credit card limit has no effect on credit cardĪccounting and should not be included in the business financial records. Some people make the mistake of thinking they must show In saying that, some bookkeepers will include the balance under the Assets section of a Balance Sheet as a negative balance, which is perfectly acceptable. The credit card balance is shown on the Balance Sheet under Liabilities in an account called Credit Card Balance Owing, because any balance on the credit card that is owed to a credit card company is like a loan from them.Īll loans are a liability because it is money you owe to another business. which report does the credit card balance go on? On the expense form template, the credit card balance shows as a normal value if it is a balance you owe the credit card company (example $250.00), but it will show as a negative red value if you have paid too much on to your credit card (example -$50.00). The Sample page shows how the credit card balance changes with each transaction in this expense form template.

or cashback rewards if you have that type of credit card – the ending total of this column is linked to the Balance Sheet under Liabilities.payments from your personal bank account – the ending total of this column is linked to the Balance Sheet under Equity as "Owner’s Capital".payments from the business bank account – the ending total of this column is linked to the Balance Sheet under Liabilities as "Business Bank Account Transfers".

Why? These represent funds that are not actual income from selling items or services, but are funds received from activities such as: There are two “Payments Received” income columns and one “Other Funds” income column. January after Renaming Heading monthly pages

0 kommentar(er)

0 kommentar(er)